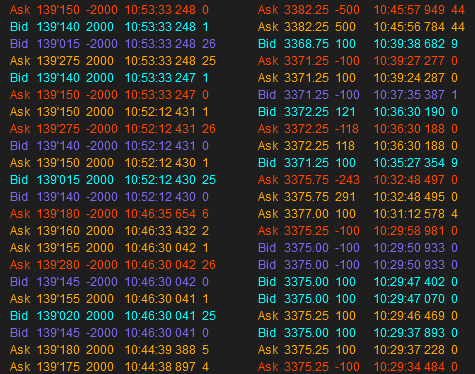

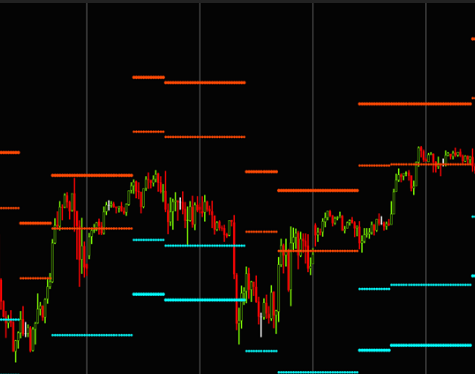

Inventory Cost Basis

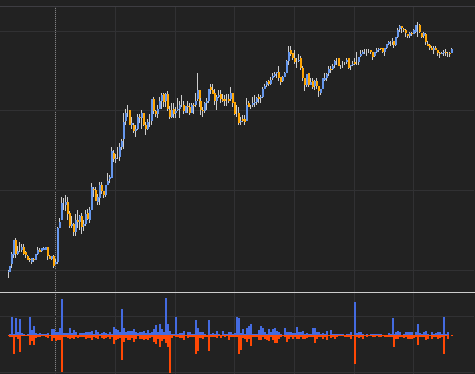

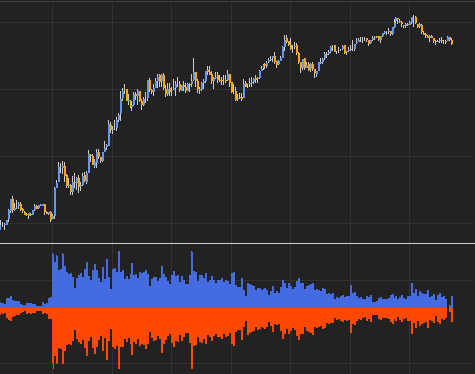

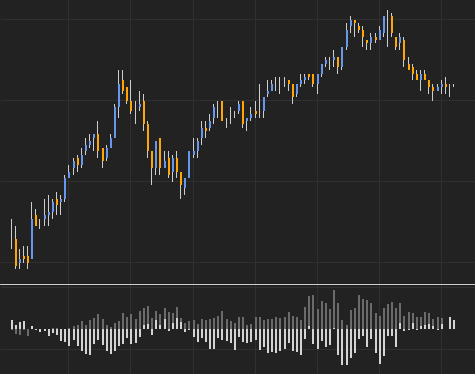

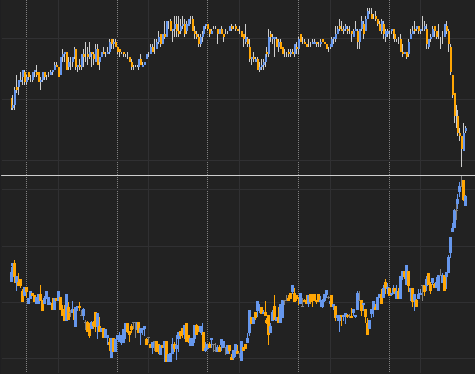

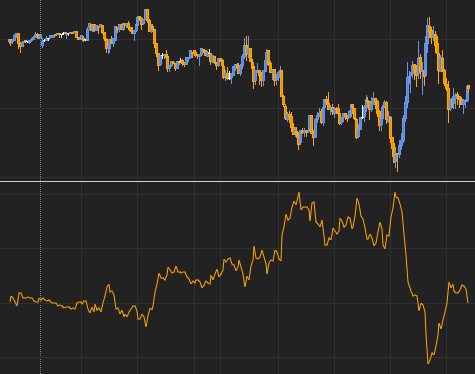

Indicates market control between buyers and sellers by estimating average positions. Market maker behavior is simulated to create best and worst case scenarios for how many positions might be open, and where they may stop out of positions.